utah solar energy tax credit

Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. IKEA has installed one.

Jairoo Com ใจร ค นหา คล งร ปภาพ ภาพฟร ร ปฟร ร ปภาพฟร ดาวน โหลดภาพฟร โหลดภาพฟร รว Solar Panels Solar Panel Technology Solar Panel Installation

The Utah Office of Energy Development administers the tax credit and has responsibility for revising the tax credit rules and certifying systems as.

. For wind geothermal electric and biomass systems with a total capacity of. This photovoltaic project has the capacity to generate 104 MW of electricity -- enough to power over 20419 Utah homes. Get Pricing Calculate Savings.

Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500. Write the code and amount of each apportionable nonrefundable credit in Part 3. Add the amounts and carry the total to TC-40 line 24.

Utah State Energy Tax Credits Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000. Find other Utah solar and renewable energy rebates and. Several large retailers in Utah have gone solar including IKEA Patagonia and Uinta Brewing Company.

Below is a list of refundable credits that Utah offers. The credit can mean a larger refund or a. Herbert also signed into law Senate Bill 141 which provides a two-year extension of a 1600 tax credit for Utah customers who adopt solar systems providing much-needed stability as the industry adapts to recently restructured solar rates for homeowners.

If you produce more than you consume you will be given a kWh credit for that excess energy. The tax credit is divided into two types of incentives. The solar tax credit is a tax reduction on a dollar-for-dollar basis.

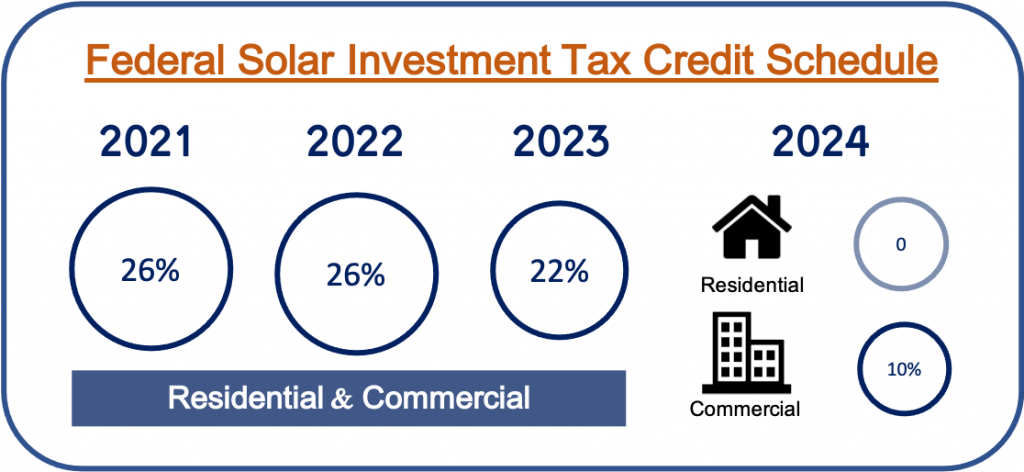

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. Ad Looking for utah tax credit for solar. This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit.

By Sara Tabin. Systems installed before December 31 2019 qualified for a 30 tax credit. Check Rebates Incentives.

For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. Your compensation rate is based on your customer class or rate schedule and will be in effect until December 31 2032. The PTC is calculated as 0035 35 per kilowatt hour of electricity produced during the projects first 48 months of operation after the Commercial Operation Date.

The first reduction would be from 2000 to 1600 in 2018. Utahs income tax credit for renewable energy systems includes provisions for both residential and commercial applications. 8 rows For solar PV systems the maximum credit decreases over time as follows.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. There is no limit to the amount that may be claimed. Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not exceed certain limits.

Currently Utah residents can claim 2000 on their state income-tax returns if they install a solar-energy system. Commercial Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil gas and alternative energy installations. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

View more solar industry data. Notable Solar Installations in Utah. For installations completed in 2021 the maximum tax credit will be 1200.

The maximum Re-newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200. Utahs solar tax credit makes going solar easy. The Office of Energy Development is tasked with updating the statewide energy plan to ensure Utahs energy future is secure innovative and reliable.

Renewable energy systems tax credit. The Utah Public Service Commission agreed Friday to let Rocky Mountain Power reduce the amount of energy credits that people receive. 31 2020 500 am.

Residential Schedules 1 2 or 3. Join us in one of our public meetings to provide your input as we begin the process of. Content updated daily for utah tax credit for solar.

The Production Tax Credit is available for large scale solar PV wind biomass and geothermal electricity generating renewable energy projects over 660 kilowatts nameplate capacity system size. Renewable Commercial Energy Systems Credit The Renewable Energy Systems Tax Credit can be applied to both residential and commercial installations utilizing solar photovoltaic solar thermal wind geothermal hydro and biomass technologies. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. In 2022 the maximum tax credit will be 800. Unless Congress renews it the tax credit will expire in 2024.

Currently you can claim the solar tax credit until 2024. Solar Energy Systems Phase-out. Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels.

Attach TC-40A to your Utah return. Find Top Rated Solar Companies in Your Area. With the new law that credit will steadily be reduced by 400 per year until its completely eliminated entirely after 2021.

Ad Free Savings Calculation. For systems installed. Utah Alternative Energy Manufacturing Tax Credit is a State Financial Incentive program for the State market.

Residential tax credits span rooftop solar as well as installations utilizing solar thermal wind geothermal hydro and biomass technologies. Utah Red Hills Renewable Energy Park was completed in 2016. Not Utah tax credit for certain people who work and have earned income.

Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014.

Solar Powered Air Conditioners A Comprehensive Guide In 2022 Solar Powered Air Conditioner Solar Air Conditioner Used Solar Panels

Solar Tax Credit Details H R Block

Viking K2 Slide Gate Operator Solar Conversion Gate Operators Solar Gates Solar

Solar Incentives In Utah Utah Energy Hub

Residential Energy Credit How It Works And How To Apply Marca

Utah Solar Incentives Creative Energies Solar

Solar Power Graphic Http Baldi2176 Viridian Com Index Asp Co La En Us Heating And Air Conditioning

Simple Diy Solar Powered Projects For Preppers Shtfpreparedness Solar Projects Renewable Energy Solar

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar Solar Design Residential Solar Passive Solar Design

Your Roof Must Be In Good Condition To Implement Solarpanels Because The Roof Is The Most Convenient Location To Implement Pan Solar Solar Energy Solar Panels

Understanding The Utah Solar Tax Credit Ion Solar

Groups Selected For Nyserda S Clean Energy Integration Challenge Lắp đặt điện Mặt Trời Hcm Khải Minh T Energy Research Future Energy Renewable Energy Resources

In Its Quest To Save Energy And To Pave A Path For Sustainable Development Punjab Has Been Expanding Its Solar Power Generat Solar Power Diy Solar Solar Power

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Exemptions Sales Tax And Property Tax 2022

Rooftop Solar Panel Inverters Water Pump Solar Epc Gujarat India U R Energy Solar Panels Solar Solar Panel Inverter